Derivatives - The Next Big, No, Make That Huge Problem

_______________________________

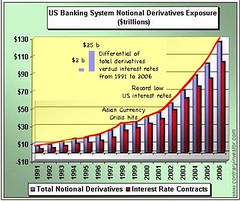

My apologies, this is the latest chart I could find on derivatives, back to 2006. The problem is much worse now. But the problem can be seen visually here:

_______________________________

_________________________

Click on image for larger view

What is the derivatives problem? But first, what is a derivative?

Derivatives are basically bets, bets on foreign currencies, stocks, interest rates or even specific bets on events like the bankruptcy of a specific company. As can be seen in the chart, interest rate bets are by far the biggest, but bets on bankruptcies - called credit default swaps - are growing. A bank concerned that one if its customers may not be able to repay a loan can protect itself against loss by transferring the credit risk to another party [i.e a bank] while keeping the loan on its books. Investopedia-Credit Derivative

Hedge funds, which we've heard so much about, hedge the bets they've made in other areas, in the derivatives market. Derivatives are like insurance policies, but have been used more to leverage investments, and this leverage has increased the risk to those participating in the growing use of derivatives.

The current estimates of the face value or "notional' value of derivatives held by U.S. banks, is $180 trillion. Most derivatives are traded outside of regulated exchanges, that is, privately. Therefore, we don't know what the real amounts actually involved are, who the parties involved are and no way of preventing or cleaning up the mess should the entire 'casino' of derivative trading or gambling, fail. These hedged bets or derivatives have grown exponentially over the last few decades and are now larger - at over 1,000 trillion dollars - than the entire world's gross domestic product - 60 trillion dollars.

Most, 97%, of all U.S. bank held derivatives are in the grubby little hands of just five major U.S. banks, JPMorgan Chase, Citibank, Bank of America, Wachovia and HSBC.

Big brokers, such as Merrill Lynch, $4.2 trillion, Morgan Stanley, $7.1 trillion, and although Lehman Brothers had less - $729 billion, in relation to its assets, its overstretched leverage i.e. greed, was one of the worst of the brokers, and hence ripe for failure as the market shorted Lehman stock.

As can be seen from the chart below, which, along with the data above can be found at - Marketoracle.org - the stack of derivatives far and away exceeds the total assets of the five major banking firms involved.

__________________________________

_________________________

How does one hedge his bets with derivatives?

Assume Bank A makes a loan - $10 billion - to Corporation B. Bank A puts that loan of $10 billion on its books as an asset. But Bank A is concerned about Corporate B's ability to pay back the loan - what if Corp B goes bankrupt? So, Bank A goes to American International Group - AIG - to hedge its risk with Corporation B and buys a credit default swap or 'insurance' from AIG in case Corporate B defaults.

Corporation B goes bankrupt and can't repay Bank A. No problem, Banks A says, and goes to AIG for payment - $10 billion plus interest - on its 'insurance' policy. Problem is, AIG has other losses from other derivatives or insurance policies it has issued to other banks and can't raise the $10 billion. Bank A now has to write down it's $10 billion loss from Corporation B. Now, Bank A doesn't have enough reserves to make further loans. And that's what banks do, make loans. Bank A then starts looking to other banks from which to borrow money from, but other banks are in the same situation as Bank A and refuse or can't loan Bank A any money. And the domino effect starts.

Take another example - interest rate derivatives, the most common and which run into the trillions of dollars.

A hot shot trader at Lehman Brothers bets interest rates will drop. He gets a derivatives contract with Bank A for $300 billion. Alone, that $300 billion would be a huge risk. But trader has a similar bet with Bank B that interest rates will rise. Like betting on both horses in a two horse race. If one horse wins you win, and if the other horse wins, you win too. You can't lose. Or can you?

Interest rates rise. Hot shot trader loses his bet with Bank A, but wins his bet with Bank B. Normally he'd take his loss with Bank A and offset it with his win from Bank B.

But, here's the problem. Bank B has suffered large losses related to its mortgage portfolio. It runs out of capital and can't raise additional capital. Bank B can't pay off it's bet to the hot shot 'Master of the Universe' Lehman Brothers trader.

Lehman Bros is now on the hook for the bet to Bank A, but can't collect from Bank B to pay Bank A. Say the trader owes 2% of $300 billion, or $6 billion. Now, the Lamborghini driving trader at Lehman Brothers can't pay off his debt at Bank A or any other debts he's placed with Banks C and D which then can't pay off its debt to Bank E and so on.

Other bookies in similar trouble went to the Federal Reserve and the US Treasury which paid JP Morgan $29 billion take over Bear Sterns, all paid for by the American taxpayer. And that is why the Federal Reserve, a private corporation, again took American taxpayer money and bought AIG - which has billions and billions of these derivatives insured - because if it didn't the entire Ponzi scam would collapse.

How can a private corporation - the Federal Reserve - take government, i.e. taxpayer, monies and buy a private insurance corporation AIG? Should not the public now own the Federal Reserve and AIG?

Who gave the Federal Reserve the right to buy a private insurance company with public monies, monies the public does not have?

There is criminal activity taking place right before our eyes on a scale that is simply mind boggling, and the general public doesn't have a friggin' clue as to what is going on.

0 comments:

Post a Comment